Employers Owe Employees a Duty of Care

Ramesh s/o Krishnan v AXA Life Insurance Singapore Pte Ltd [2016] 4 SLR 1124

1. Introduction

Ramesh s/o Krishnan v AXA Life Insurance Singapore Pte Ltd [2016] 4 SLR 1124 highlighted the importance of employers preparing employee reference form, in a fair and accurate manner. This is to avoid unjustifiably prejudice against the former employee’s prospects of obtaining new employment.

We acted for Ramesh s/o Krishnan (“Ramesh”) against his former employer, AXA Life Insurance Pte Ltd (“AXA”).

2. Background

In 2005, Ramesh was employed by AXA as an adviser and financial services associate manager.

In 2007, he rose to the rank of a financial services director (“FSD”). As an FSD, Ramesh led a group of advisers under the “Ramesh Organisation”.

In 2009, Ramesh was again promoted to the position of a senior FSD in the Ramesh Organisation.

It seems that Ramesh performed well since he joined AXA. Aside from being promoted twice during between 2005 and 2010 or 2011 with AXA, Ramesh also won numerous awards and accolades. Ramesh was also one of AXA’s best compensated advisers, two months before he departed from AXA.

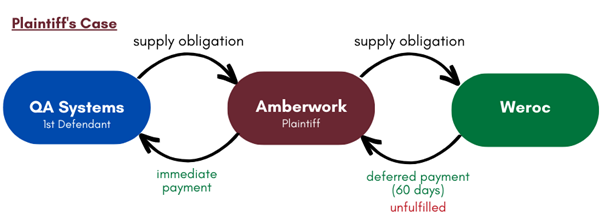

Ramesh then applied to join Prudential Assurance Company Singapore Pte Ltd (“Prudential”), and subsequently applied to join Tokio Marine Life Insurance Singapore Limited (“Tokio Marine”).

Financial institutions regulated by the Monetary Authority of Singapore (“MAS”) are required to obtain a Representative Notification Framework (“RNF”) Licence before appointing a representative to engage in regulated activities under the Financial Advisers Act (Cap 110, 2007 Rev Ed) and the Securities and Futures Act (Cap 289, 2006 Rev Ed). In addition, these financial institutions are required to conduct due diligence checks on the representatives they propose to appoint (including obtaining a reference check to be provided by the previous employer.

Accordingly, Prudential requested for a reference from AXA. In the reference provided by AXA, it was highlighted that Ramesh had poor record in terms of persistency ratios and ethical conduct. Prudential decided not to hire Ramesh. Ramesh’s application to join Tokio Marine was declined too.

Ramesh sued AXA for defamation, malicious falsehood, and negligence. These three claims were dismissed in the High Court. It was held in the High Court that, for negligence claim, a duty was owed but there was no breach and it was not shown that Ramesh’s reference check caused him loss of employment. Ramesh then appealed against the decision in relation to negligence.

3. Conclusion

We were successful in arguing a novel point of law in the Court of Appeal in relation to standard of care in tort applicable in the context of a former employer preparing a performance reference for an employee. The Court of Appeal accepted our argument that the defendant-financial institution had breached its duty of care in preparing a reference check for a former financial services director, whom we act for.

The Court also found that the defendant’s breach caused the financial services to be deprived of employment in another financial institution. Accordingly, the Court reversed the High Court judge’s decision which had dismissed the financial services director’s claim, and remitted the matter to the High Court judge for assessment of damages.