Reserve Management Powers of Shareholders

Chan Siew Lee v TYC Investment Pte Ltd & Ors & anor appeal [2015] 5 SLR 409

1. Introduction

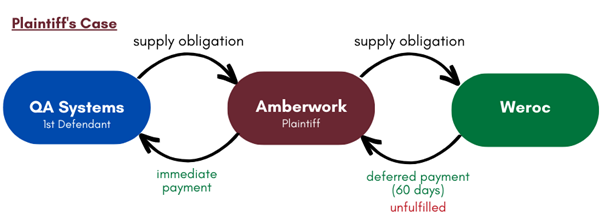

We acted for Jannie Chan Siew Lee (“JC”) in the matter involving TYC Investment Pte Ltd (“TYC”), a family holding company. There were two directors, Henry Tay (“HT”) and JC, holding 46% and 44% of the voting rights in TYC. The remaining 10% of the voting rights were held by the children, of which 5% was held by their son, Michael.

2. Background

Following the divorce of HT and JC in 2012, various agreements were entered as part of the divorce settlements. TYC is a party in one of these agreements.

Also, a payment voucher system for TYC was agreed by HT and JC where neither HT nor JC will sign a cheque on TYC’s bank accounts unless the other has signed a voucher approving (the “Payment Clause”). The Payment Clause provides that:

Payment voucher system for all future payments for TYC. Neither [HT] nor [JC] will sign a cheque on TYC’s bank accounts unless the other has signed a voucher approving.

Subsequently, JC invoked the Payment Clause to refuse to approve certain payments by TYC, including payment for advisory services provided by KPMG Services Pte Ltd. HT then made these payments himself and reimbursements were sought thereafter. JC did not approve the reimbursements. An extraordinary general meeting (“EGM”) was called by HT to approve the reimbursements.

At the EGM, resolutions were passed by HT and Michael, both hold 51% of the voting rights at the EGM, to:

(a) approve the reimbursements made by HT;

(b) authorise HT to unilaterally sign cheques and vouchers to make payments on behalf of TYC;

(c) enable TYC to appoint solicitors and to commence legal proceedings against JC for various matters, including, a declaration that TYC’s shareholders had reserve powers of management to approve payments where the board of directors was deadlocked;

(d) among others.

3. Conclusion

This case, Chan Siew Lee v TYC Investment Pte Ltd and Ors and anor appeal [2015] 5 SLR 409, which was before the Court of Appeal dealt with the novel and contentious point of law on what (if any) reserve management powers shareholders have when the board of directors is at a deadlock.