Cross-border bankruptcy involving a seizure of $124m

Cross-border Bankruptcy involving a Japanese director’s assets

1. Introduction

We acted for a Japanese trustee in bankruptcy who was pursuing SGD 124 million worth of monies hidden in various Singapore bank accounts by one Masahiko Nishiyama. A Kyoto court had adjudicated Nishiyama to be bankrupt, as well as convicted Nishiyama of dissipating assets around the world in fraud of Nishiyama’s creditors. In granting the order, the High Court recognised a foreign trustee in bankruptcy of an individual bankrupt. This was the first time this has been done by a Singapore court.

2. Background

Nishiyama was a director of Japanese company Pexim Co. Ltd (“Pexim”) between 1971 and 2003. He held approximately 16,850 Pexim’s shares worth 16.85 million yen. Pexim was dissolved in 2004.

From 1989 to 1992, Pexim entered into a series of loan and quasi-loan agreements with the predecessor of The Resolution and Collection Corporation (“RCC”), a government-owned subsidiary of the Deposit Insurance Corporation of Japan which deals with salvaging bad loans from failed housing companies. Nishiyama underwrote these agreements.

In 2012, the Kyoto District Court ordered that Nishiyama, jointly and severally with Pexim, pay RCC the outstanding loans which by then amounted to approximately 43 billion yen (USD 395 million) including interest. It later emerged that Nishiyama had dissipated his assets worldwide on a massive scale, including bank accounts in Singapore, Hong Kong and Canada. Criminal proceedings were brought in Japan and he was convicted and sentenced to prison for concealing assets for the purposes of defeating enforcement proceedings.

Mr Hiroshi Morimoto, Nishiyama’s Japanese-appointed trustee in bankruptcy, went on to pursue Nishiyama’s assets in Singapore.

We successfully persuaded the High Court to recognise the bankruptcy order made by the Kyoto District Court, which included recognising that Nishiyama was bankrupt and that Morimoto was his trustee in bankruptcy. We also obtained a declaration that certain bank accounts in Standard Chartered, Bank Julius Baer and Credit Suisse were beneficially owned by Nishiyama, though they may not have been held in his name. We did this by undertaking a tracing exercise based on documents flushed out through a worldwide Mareva injunction obtained in the course of the proceedings.

The combined value of these accounts stood at approximately SGD 124 million (US 90 million). Our client was allowed to proceed to seize these assets.

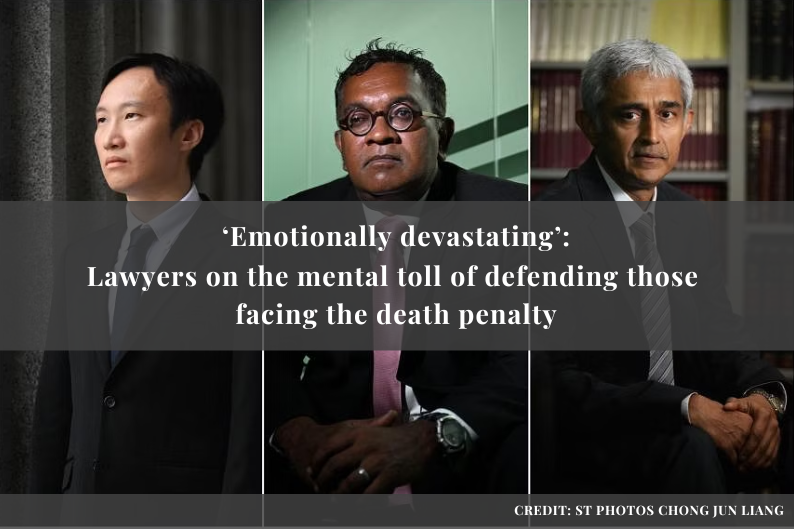

3. Eugene comments in The Straits Times

Recognition of the bankruptcy order would be aligned with the universalist approach to cross-border insolvency and it would be entirely sensible to assist in the bankruptcy proceedings initiated in Japan.